Use law to protect against fintech fraud

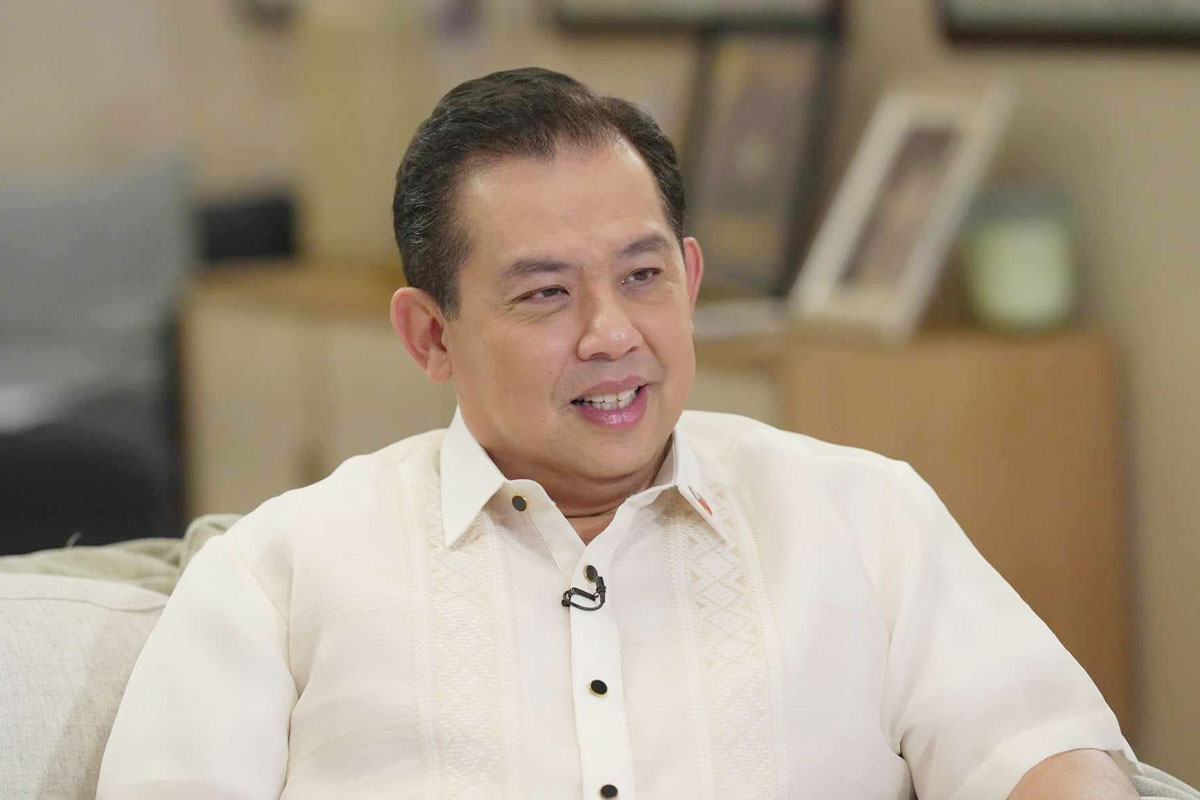

SENATOR Sherwin Gatchalian urged financial technology (fintech) users to invoke measures set in Republic Act No. 11765 or the Financial Products and Services Consumer Protection Act and its implementing rules and regulations following an apparent foiled attempt by suspected cyber criminals to siphon off money from GCash, a popular fintech platform in the country.

“Incidents like this diminish the confidence of consumers not only in using and adopting fintech in their daily transactions but also in the country’s financial system in general, which could potentially impede economic growth,” Gatchalian emphasized.

He said enhanced consumer protection is the main objective of R.A. 11765, which the senator co-authored. The law, enacted in May last year, aims to protect consumers from financial fraudsters by empowering regulators to proactively respond and set up measures that address consumer concerns.

Citing provisions from Bangko Sentral ng Pilipinas’ Circular No. 1160, Gatchalian said victims should immediately report any unauthorized transaction to their financial institution so it can investigate the incident. Pending the result of the investigation, complainants are protected as the financial institutions concerned are empowered to take necessary actions to protect the consumers’ interest by providing reasonable accommodations such as a non-withdrawable provisional credit of the disputed amount and other necessary actions to protect the consumers such as but not limited to account blocking or freezing of funds.

Gatchalian emphasized that GCash and other fintech platforms should proactively ensure that ordinary financial products and service consumers are sufficiently protected from hacking, fraud, and other cybercrimes. Based on reports, a considerable number of GCash clients have complained of unauthorized cash transfers from their respective accounts. This then brought anxiety and confusion to a lot of their customers, especially since the GCash app was unavailable for a while.

“Kailangang siguruhin ng mga online payment services ang kaligtasan at seguridad ng pinaghirapang pera ng mga consumers para magkaroon ng kompyansa ang ating mga kababayan,” Gatchalian said.